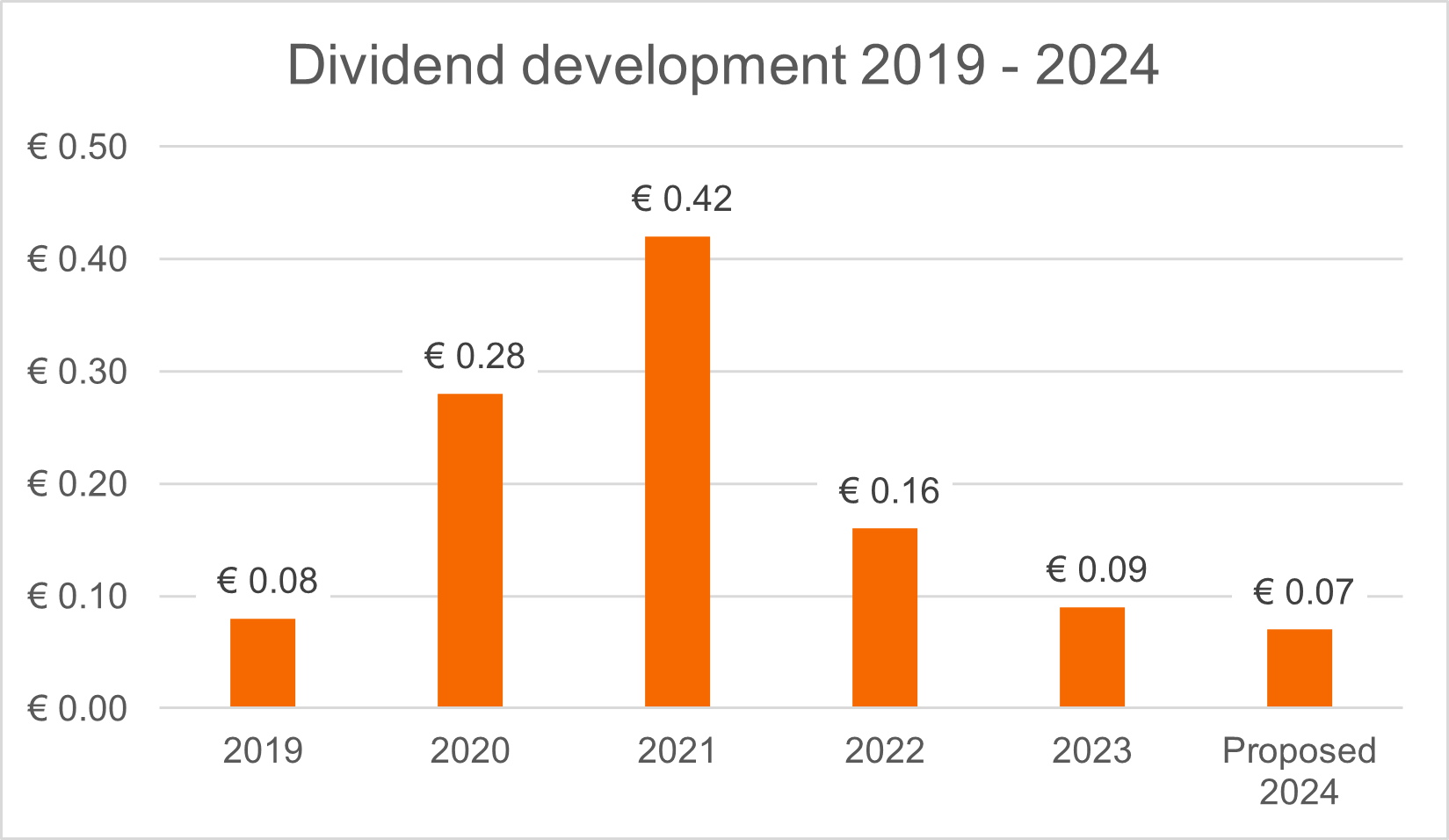

PostNL will propose to the Annual General Meeting of Shareholders (AGM), to be held on 15 April 2025, a dividend of €0.07 per ordinary share for 2024. This represents a pay-out ratio of 80% of normalised comprehensive income. After approval by the AGM, the final dividend of €0.04 will be paid. Dividend per share will be paid at the shareholder’s election, either in cash (default) or in ordinary shares. The dividend in shares will be paid out of additional paid in capital as part of the distributable reserves, free of withholding tax in the Netherlands.

The conversion ratio will be based on the volume-weighted average share price (VWAP) for all PostNL shares traded on Euronext Amsterdam over the last three trading days, including the final day of the election period. The value of the stock dividend, based on this VWAP, will, subject to rounding, be targeted at but not be lower than the cash dividend. There will be no trading in stock dividend rights.

Dividend calendar

Final dividend 2024 | Interim dividend 2025 | |

|---|---|---|

17 April 2025 | 6 August 2025 | Ex-dividend date |

22 April 2025 | 7 August 2025 | Record date |

23 April 2025 | 8 August 2025 | Start election period |

7 May 2025 | 21 August 2025 | End election period and determination of conversion rate |

9 May 2025 | 25 August 2025 | Payment date |

Dividend policy

On 21 February 2020, the Board of Management, with the approval of the Supervisory Board, adopted an adjusted dividend policy to align with normalised EBIT and free cash flow as key performance indicators. The main elements of the dividend policy are:

- Dividend distribution conditional on being properly financed in accordance with PostNL’s financial framework

- The aim is to pay dividend that develops substantially in line with operational performance

- Pay-out ratio of around 70% - 90% of normalised comprehensive income

- Shareholders are offered a choice to opt for cash or shares

- Interim dividend set at ~ 1/3 of dividend over prior year

These guidelines will be pursued subject to the financial results and equity position of PostNL. Notwithstanding these guidelines, the Board of Management may establish, with the approval of the Supervisory Board, the amount to be appropriated to the reserves and/or the amount of the dividend in the light of particular circumstances. PostNL’s dividend policy will be reviewed annually to ascertain that they correspond with PostNL’s financial policy and that PostNL continues to distribute dividends.

Definition normalised comprehensive income

Normalised comprehensive income is defined as profit attributable to equity holders of the parent, adjusted net for tax for significant one-offs and special items (including fair value adjustments).

Articles of Association and dividend

Preference shares B

If preference shares B have been issued and are outstanding, PostNL first has to pay dividends on the paid-up part of the nominal value of such shares, at a rate of one to three percentage points above the average 12-monthly EURIBOR (EURO Interbank Offered Rate), weighted to reflect the number of days for which the payment is made over the financial year to which the distribution relates.

Ordinary shares

The Board of Management shall determine, subject to the approval of the Supervisory Board, what part of the profit is to be appropriated to the reserves after payment of dividends on the preference shares B (if applicable). The part of the profit remaining after the appropriation to the reserves shall be proposed to the General Meeting of Shareholders to be distributed as dividend on the ordinary shares.

When will PostNL pay no dividend?

PostNL cannot pay dividends if the payment would reduce shareholders' equity below the sum of the paid-up and requested part of the capital and any reserves.

If a loss is sustained in any year, we may not distribute dividends for that year and we may not pay dividends in subsequent years until the loss has been compensated for out of subsequent years' profits.